Many reasons exist exactly why you must purchase an excellent plot of land even though you commonly happy to generate towards the it immediately.

Maybe you’ve discover the perfect location for a house or vacation location, and you also should set aside they for future years. Or possibly you’ve receive a best-proper parcel from the woods to escape so you’re able to on your newly up-to-date Rv .

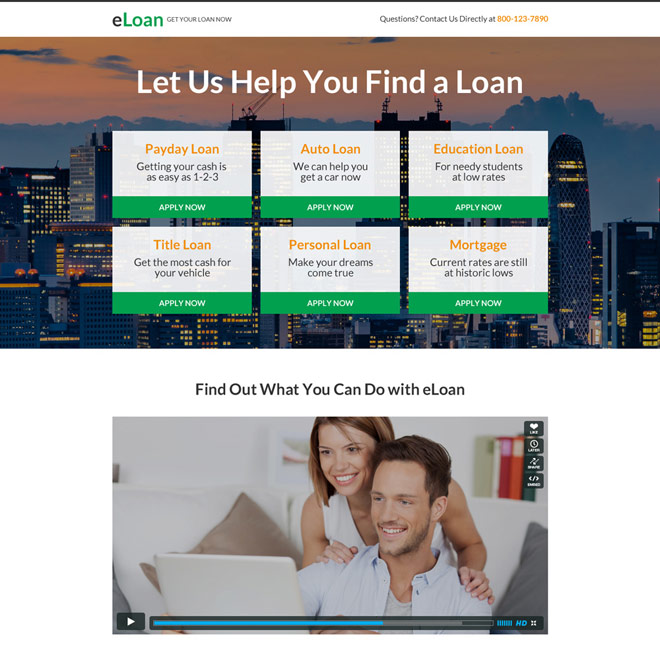

If you want to proceed together with your package, you’ll likely you would like funding to really make the get. What kind of mortgage you should get to get property often confidence the cost of new land, the manner in which you decide to use it, and just how high a down-payment you are able to.

Keep reading to learn exactly how a consumer loan for choosing homes compares to taking an area financing, and additionally other options you’ll be able to imagine to aid money an area buy.

What is a personal bank loan?

An unsecured loan makes you get a lump sum payment off currency to pay for expenses, should it be personal credit card debt, a medical costs, or an aspiration vacation. Then you definitely pay those funds (also attract) over the years. You might acquire a large or small amount, based on your needs and you can credit history, and you may always explore a consumer loan for just about whatever you such.

Most signature loans is unsecured loans , and therefore they don’t need you to right up security (just like your house, vehicles, or other resource). Unsecured personal loans might have large rates of interest than funds you to is actually safeguarded once the, in the place of collateral, loan providers usually evaluate all of them as the riskier.

For people who get a personal loan online and the borrowed funds is eligible, you can typically expect to get currency shorter than simply with various other type of resource. You’ll get the cash in a single lump sum payment – and you will be anticipated to pay off your debt inside repaired monthly money in this a predetermined time period.

One of the many advantages of an unsecured loan for choosing residential property is the fact consumers is basically utilize this brand of financing for pretty much one private mission, away from paying off established debt ( highest bank card balance , such as for instance, or a huge medical expenses) in order to financial support a huge buy-and therefore boasts to order land.

Signature loans may also provides a lot fewer initial costs than other systems out of finance for selecting belongings, since individuals may not have to pay for appraisals, surveys, term looks, and other settlement costs. But not, interest rates private fund have left upwards over the past seasons of the savings.

Whether a personal bank loan is an appropriate selection, but not, can get believe how much you will have to borrow to acquire the parcel of land you desire of course you can aquire acknowledged for a financial loan that will not hold high attract.

Instead, loan providers can look from the good borrower’s credit to decide when they eligible for such loan and just what conditions have a tendency to be

Just how much you might obtain is key. Consumer loan numbers typically vary from $step 1,000 in order to $fifty,000, dependent on your income, existing obligations, credit rating, plus the financial. Among one thing in support of cash advance america Ragland Alabama unsecured loans is the money comes rapidly.

If you are not in almost any rush to create on home, whether or not, or you expect you’ll lay a property otherwise 2nd house to your package soon, you’ll likely need to take out a supplementary loan. If so, you are looking at paying a few finance on the other hand: the private loan on property get and you will any kind of sort of financing you determine to play with when you begin construction.

Therefore seeking an unsecured loan to possess belongings? Personal loans have some benefits that may cause them to a good choice for buying residential property. However, there are even certain drawbacks. Listed here is a fast summary:

دیدگاهتان را بنویسید