The latest criticism isnt a finding otherwise ruling that defendants have broken legislation

- Mishandled issues insurance rates: If a servicer administers a keen escrow take into account a debtor, an effective servicer have to generate punctual insurance coverage and you can/or tax repayments on behalf of the newest debtor. Ocwen, but not, features allegedly didn’t make fast insurance rates repayments to fund borrowers’ home insurance advanced. Ocwen’s disappointments lead to the lapse away from homeowners’ insurance policies to possess more than ten,000 consumers. Specific consumers was forced with the force-put insurance coverage.

- Bungled borrowers’ private home loan insurance coverage: Ocwen allegedly did not cancel borrowers’ private home loan insurance rates, otherwise PMI, during the a timely way, resulting in users to help you overpay. Essentially, borrowers have to get PMI when they get a home loan that have good downpayment out-of less than 20%, or once they refinance its home loan with less than 20% collateral in their assets. Servicers need certainly to stop a beneficial borrower’s requisite to blow PMI in the event the dominating harmony of the financial is at 78 percent of your property’s brand spanking new well worth. Since 2014, Ocwen has actually did not prevent borrowers’ PMI punctually once understanding suggestions within the REALServicing system is actually unreliable otherwise shed completely. Ocwen fundamentally overcharged consumers about $1.2 mil to possess PMI premiums, and you can reimbursed it money only following the truth.

- Deceptively registered and energized individuals for include-into the items: Whenever upkeep borrowers’ mortgage loans, Ocwen presumably signed up specific people into the incorporate-to the activities by way of inaccurate solicitations and you may as opposed to the concur. Ocwen after that charged and you can compiled payments from the people.

- Did not help heirs looking to foreclosures selection: Ocwen presumably mishandled makes up successors-in-interest, or heirs, to a deceased borrower. Such $500 payday loan Indiana no state id no credit check users integrated widows, college students, or any other relatives. Consequently, Ocwen don’t securely acknowledge anybody since heirs, and you may thereby refuted assistance to assist end foreclosures. On occasion, Ocwen foreclosed to the people that may have been entitled to help save these land as a result of a loan modification or any other losings mitigation option.

- Don’t acceptably check out the and respond to borrower grievances: In the event that an error is made on upkeep regarding a mortgage financing, a servicer must basically sometimes right the new error acquiesced by the latest debtor, called a notice from mistake, or have a look at brand new so-called error. Just like the 2014, Ocwen has allegedly consistently failed to properly recognize and you will browse the complaints, otherwise build necessary corrections. Ocwen changed the plan in to target the problem its label cardio had when you look at the accepting and you may increasing issues, however these transform decrease short. Under its the plan, individuals still have to complain no less than 5 times from inside the nine days in advance of Ocwen immediately escalates the grievance are resolved. Since the , Ocwen has had over 580,000 observes out of error and you may problems of more three hundred,000 more individuals.

- Did not give complete and you can specific mortgage suggestions to help you the servicers: Ocwen possess presumably failed to include over and you may exact borrower information if this marketed the rights to help you solution tens of thousands of finance in order to this new mortgage servicers. It has got impeded the fresh new servicers’ services so you can adhere to rules and you will buyer advice.

The latest Bureau as well as alleges one to Ocwen have failed to remediate consumers to your damage it has brought about, such as the issues it’s created for striving borrowers who have been into the default on their money otherwise that has recorded for bankruptcy

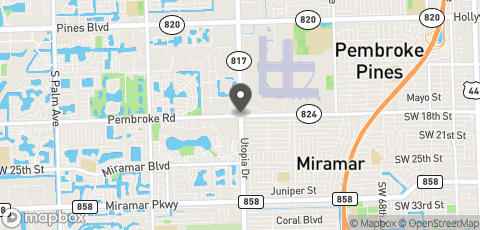

And their issue, submitted when you look at the government section court towards the South Section out-of Florida, the brand new CFPB aims a legal buy requiring Ocwen to follow along with financial maintenance laws, render save to possess users, and you may spend penalties.

Brand new criticism is not a finding or governing your defendants have actually broken the law

- Botched escrow account: Ocwen takes care of escrow makes up about more than 75 % of fund it attributes. Ocwen enjoys allegedly botched first tasks in the dealing with these borrower profile. On account of program breakdowns and you can an over-reliance upon by hand entering guidance, Ocwen features presumably failed to run escrow analyses and you can delivered particular borrowers’ escrow statements later or perhaps not whatsoever. Ocwen and presumably did not properly account fully for and implement repayments of the borrowers to deal with escrow shortages, such as for instance alterations in the newest membership when possessions taxes increase. One to consequence of so it failure has been that particular individuals has actually repaid wrong amounts.

دیدگاهتان را بنویسید