Your credit rating was a score away from just how probably youre to repay money your obtain. When you have a high rating, you happen to be said to be a low chance while the a debtor. Anything significantly more than 700 is fairly higher — probably the most commonly used rating assistance start from 300 to 850.

Your credit score can impact everything in ways, so there are many ways a top credit rating is going to save your currency. Several masters, particularly, will save you several thousand dollars.

Ideal credit card possibilities

If you find yourself getting started that have credit, their bank card choices are limited. The fresh notes you’ll be able to rating would be light with the professionals, and you will have to pay a protection put simply to unlock credit cards. Extremely beginning handmade cards in addition to do not have much to provide inside the terms of rewards, bonuses, or any other benefits.

With high credit history, the newest card solutions get much better. Creditors are curious about generating your business, and so they remove all the comes to an end with their top traveling advantages cards and money straight back notes. Here are some examples of charge card provides you could rating if you have a leading credit rating:

- Sign-up bonuses worth $200 or more

- Large advantages cost on your own requests

- A good 0% intro Annual percentage rate to stop interest charge

- Cost-free buy and you may travel protections

If you have a leading credit score, be sure you are taking advantage of it.Click on this link observe the curated variety of the best credit cards and unlock you to now. Discover notes with men and women keeps for the number above — and more.

Lower rates of interest into the financing

A top credit score mode you can buy straight down interest rates when borrowing from the bank money. But most people don’t realize just how much of a significant difference it creates.

Why don’t we consider perhaps one of the most well-known type of money by way of example: the new 30-seasons financial. On a thirty-seasons financial to have $three hundred,000, a leading credit history can save you more than $fifty,000. The following is a review of mortgage will cost you based on their FICO Rating (the most popular particular credit rating of the lenders), based on analysis regarding MyFICO.

Lower automobile insurance

For the majority says, insurance vendors can use your credit history setting the premiums. Vehicle operators with a high score rating less costs, if you find yourself vehicle operators having lowest results is penalized with additional costly vehicle insurance. It is a questionable routine, but research has discovered that people with low credit ratings file far more insurance policies claims an average of.

We’re not only speaking of an additional $5 or $ten a month, possibly. People with poor credit shell out more than double the having vehicle insurance policies just like the drivers that have higher level borrowing. Here’s the mediocre number for each classification taken care of automobile insurance when you look at the 2023 therefore the federal mediocre, centered on investigation gathered by Motley Deceive Ascent:

- National mediocre: $step 3,017

- Drivers with advanced credit: $1,947

- Drivers that have poor credit: $4,145

Countless items enter into the automobile https://clickcashadvance.com/payday-loans-ca/ insurance cost. But any kind of things becoming equivalent, a premier credit rating might help save you $step 1,000 in order to $2,000 or more.

Ways to get a premier credit rating

Your credit score lies in their reputation credit money. To construct borrowing from the bank, you should borrow money and you can pay it back on time.

You could do so it which have sometimes a charge card otherwise financing. Playing cards are the higher alternative, as you don’t need to pay interest if you use them. For folks who pay your own card’s full statement equilibrium each month, you won’t be charged desire on your sales.

- Play with a credit keeping track of provider observe their rating.

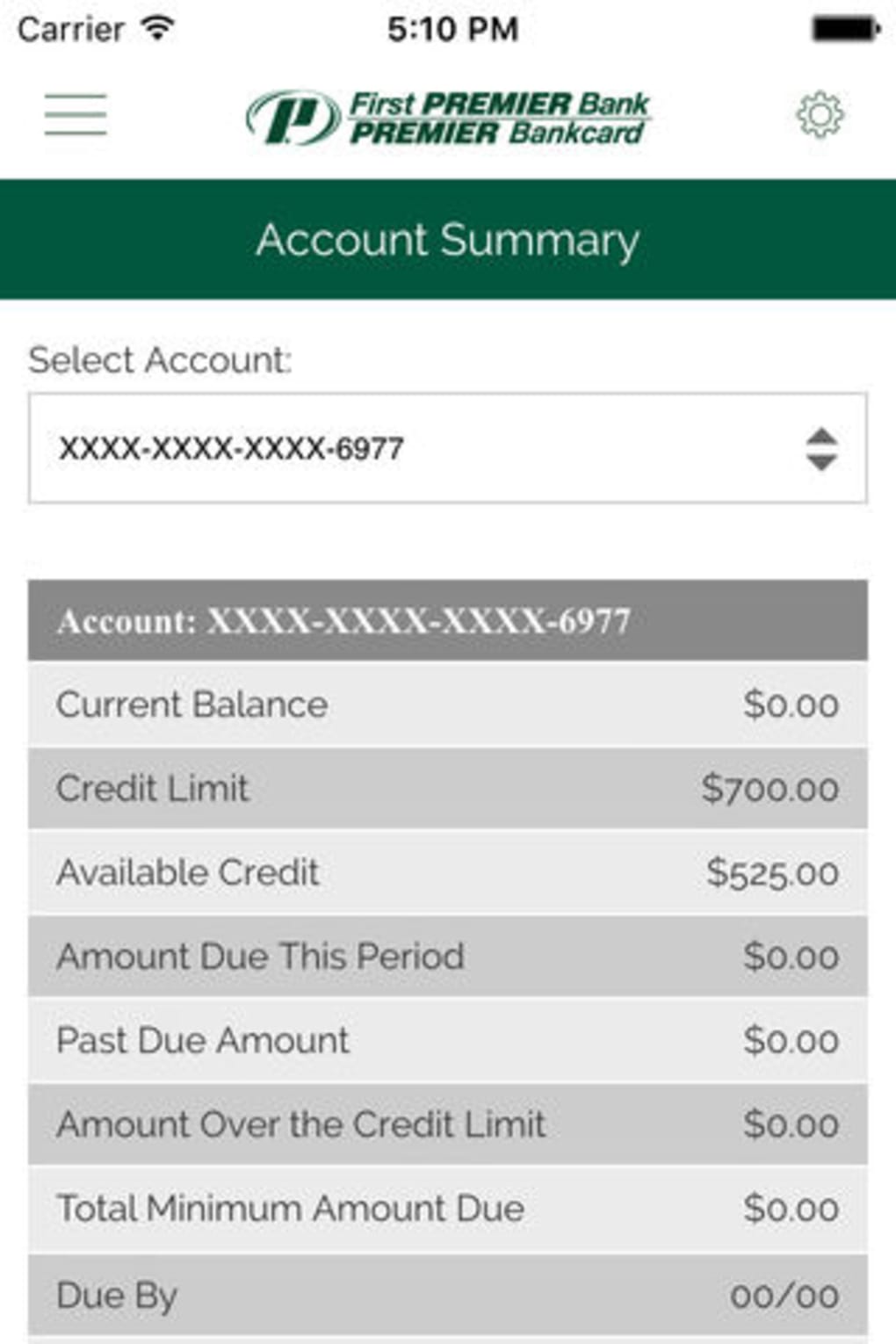

- Do not overspend on your own credit cards — keep harmony not as much as 30% of your own credit limit.

It needs a small strive to get a premier credit rating, but the outcome are worth your while. A good credit score produces existence much easier, so that as you spotted, it can also save a king’s ransom.

Alert: highest cash return cards we now have seen presently has 0% intro

It charge card isn’t just a it’s so outstanding which our positives utilize it physically. It possess a 0% introduction Annual percentage rate getting 15 days, a money back price as much as 5%, and all sorts of for some reason for no annual fee!

We are company believers on the Golden Code, that’s the reason editorial opinions are ours alone and get maybe not already been in past times reviewed, accepted, or supported from the provided entrepreneurs. Brand new Ascent will not safety every also provides in the business. Article blogs throughout the Ascent was independent on the Motley Deceive article content that’s created by a unique analyst party.The fresh new Motley Fool provides a disclosure coverage.

Repaid Post : Blogs created by Motley Fool. The planet and Mail wasn’t on it, and you will thing was not examined just before publication.

دیدگاهتان را بنویسید