The real difference issues once the the second lien was using in order to a great very first lien. Anytime a borrower non-payments with the a loans duty, the fresh new collector in the first-lien reputation takes concern so you can get paid off.

A good HELOC is appealing to people who want to feel able to availability their equity by way of an excellent rotating line of credit. Residents may want an initial-lien HELOC more a moment home loan for a couple reasons.

- Want to make use of the fresh new HELOC to pay off the rest harmony on your own first-mortgage financing.

- Was drawing near to the termination of the financial identity and want to maximize any leftover home loan desire write-offs it is possible to claim.

- Really wants to spend a lower life expectancy interest rate for mortgage personal debt.

First-lien HELOCs is simpler to qualify for than next-lien HELOCs, and they may offer way more advantageous interest levels. 2nd liens include riskier getting lenders and may even provides more strict borrowing conditions or hold higher interest rates.

First-lien HELOCs usually supply the exact same gurus just like the second-lien HELOCs. Filled with accessibility a flexible line of credit through debit card, papers checks, otherwise electronic transmits so you’re able to a bank checking account. Almost every other prospective masters become down rates of interest, longer draw attacks, reduced stringent borrowing from the bank conditions, and higher credit restrictions.

Ways to get a first-lien HELOC

- The original home loan try repaid. For people who already paid back your own new financial in full, our home has no liens to date, therefore good HELOC certainly are the merely a fantastic loans and, therefore, the original lien with the household. So it gurus your since you may draw facing their security as requisite, and you may be able to deduct the attention your paid back.

- Utilize the money from new HELOC to repay your own mortgage. Brand new HELOC manage then get to be the first lien, replacing the mortgage and you will leaving you with just you to monthly payment to make. In this instance, you could potentially alter your dated home loan with a new one to at a possibly straight down interest rate. You could mark facing your own home’s equity to cover expenditures, and you might also get the main benefit of a mortgage desire deduction.

Really does which have a first-lien HELOC i would ike to make use of significantly more security?

Its around for every single lender to choose how much cash you can use which have a primary-lien HELOC. Essentially, lenders look for individuals that have an optimum loan-to-value ratio in the 80% in order to ninety% variety, although some you will knock one to around 95%.

A first-lien HELOC you will allows you to borrow more an additional-lien HELOC if the financial enables a high maximum LTV on that unit.

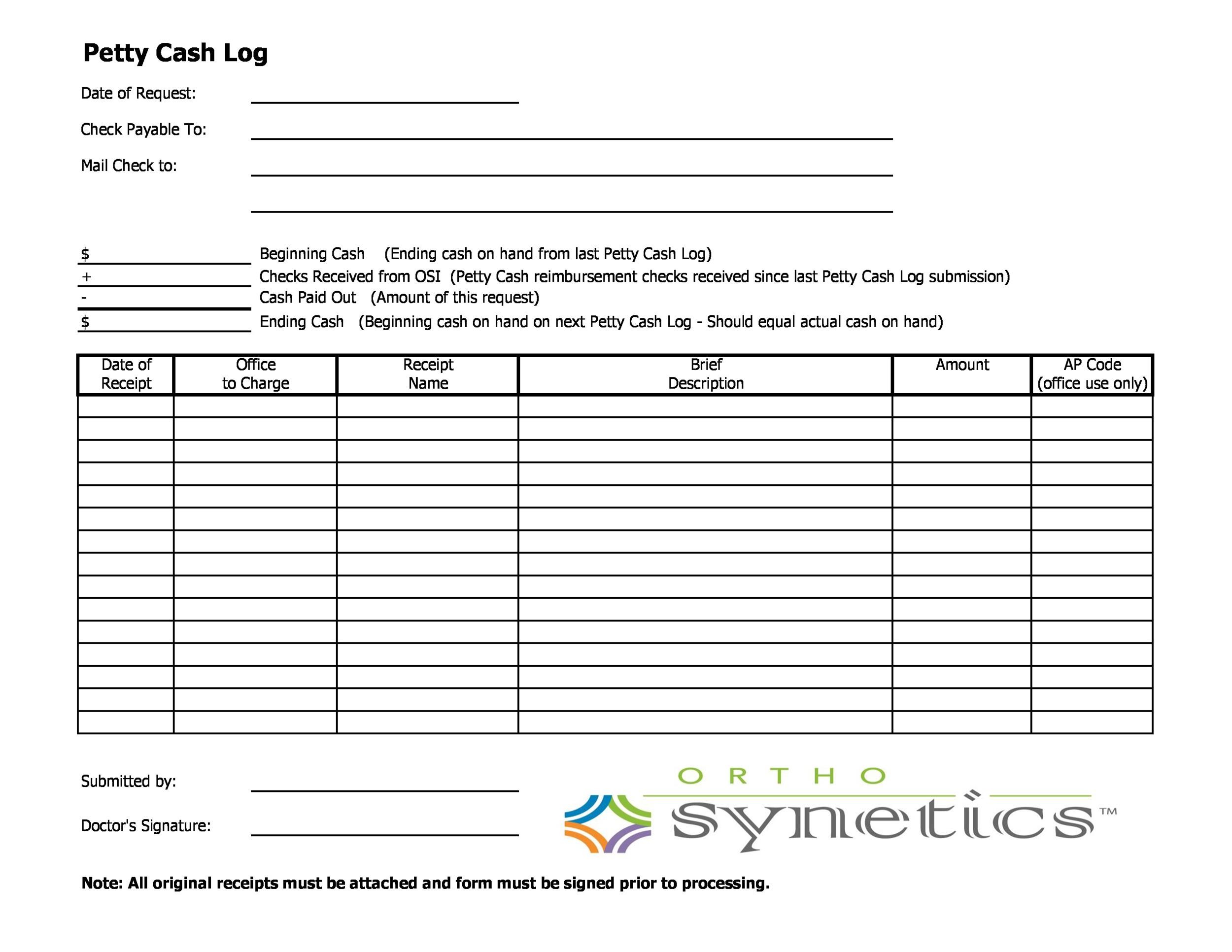

Case in point regarding how much cash guarantee you happen to be in a position to make use of if you’d like to replace your most recent mortgage with a primary-lien HELOC:

If you subtract new a great home loan financial obligation ($150,000) out of your lender’s max LTV ($240,000), you’d has actually $90,000 of your own HELOC leftover right after paying from the first mortgage.

If you alter your mortgage with an initial-lien status HELOC?

- Is the HELOC interest rate alot more good? In that case, paying off the mortgage with the HELOC can make sense. You might continue to have the ability to draw on your left guarantee to utilize any way you want. And because you’d simply have you to mortgage, you are not including a separate mortgage repayment to the monthly finances.

- ‘s the HELOC price repaired or varying? A varying-price alternative means monthly obligations is actually faster foreseeable. A life threatening upsurge in your own HELOC payment you can expect to put a critical strain on your financial budget.

- Really does the newest HELOC suit your budget?Since a first-lien HELOC is actually shielded by your household, your undertake the possibility of losing your https://clickcashadvance.com/payday-loans-vt/ house for folks who standard. So it is vital that you influence in which an initial-lien HELOC might fit into your financial allowance and you may what resources might need certainly to slip right back to generate financing payments when your business otherwise income condition alter.

دیدگاهتان را بنویسید