FHA Mortgage 15 Season 29 Seasons

Progressive Credit Alternatives has the benefit of a few of the most competitive repaired rates FHA mortgages into the Minnesota and you may Wisconsin. Regardless if you are selecting good 15-year loan otherwise a 30-12 months loan, a predetermined price FHA financial can provide economic stability when you look at the an effective arena of economic suspicion.

These types of fund are a great alternative whenever minimal down-payment was a top priority. FHA needs up-front financial insurance https://paydayloanalabama.com/albertville/ coverage in fact it is funded to the mortgage and you will a month-to-month premium.

Having a fixed rate FHA financial, the interest and you can payment will remain the same to own the entire identity of mortgage. Fixed rate FHA mortgage loans are popular because they protect residents from percentage surprises and are generally extremely easy. FHA Fixed Rates Mortgages appear in regards to fifteen to help you thirty years.

Virtual assistant Financing Being qualified Pros

Which have a home loan could end up being the most significant and more than extremely important investment decision of lives and selecting the most appropriate home loan try a significant an element of the decision making. Progressive Financing Alternatives also provides some of the most competitive repaired rates Virtual assistant mortgage loans inside the Minnesota and Wisconsin. Regardless if you are selecting an effective 15-year loan otherwise a thirty-seasons financing, a predetermined rate Va home loan you will definitely provide monetary stability during the a great field of economic suspicion.

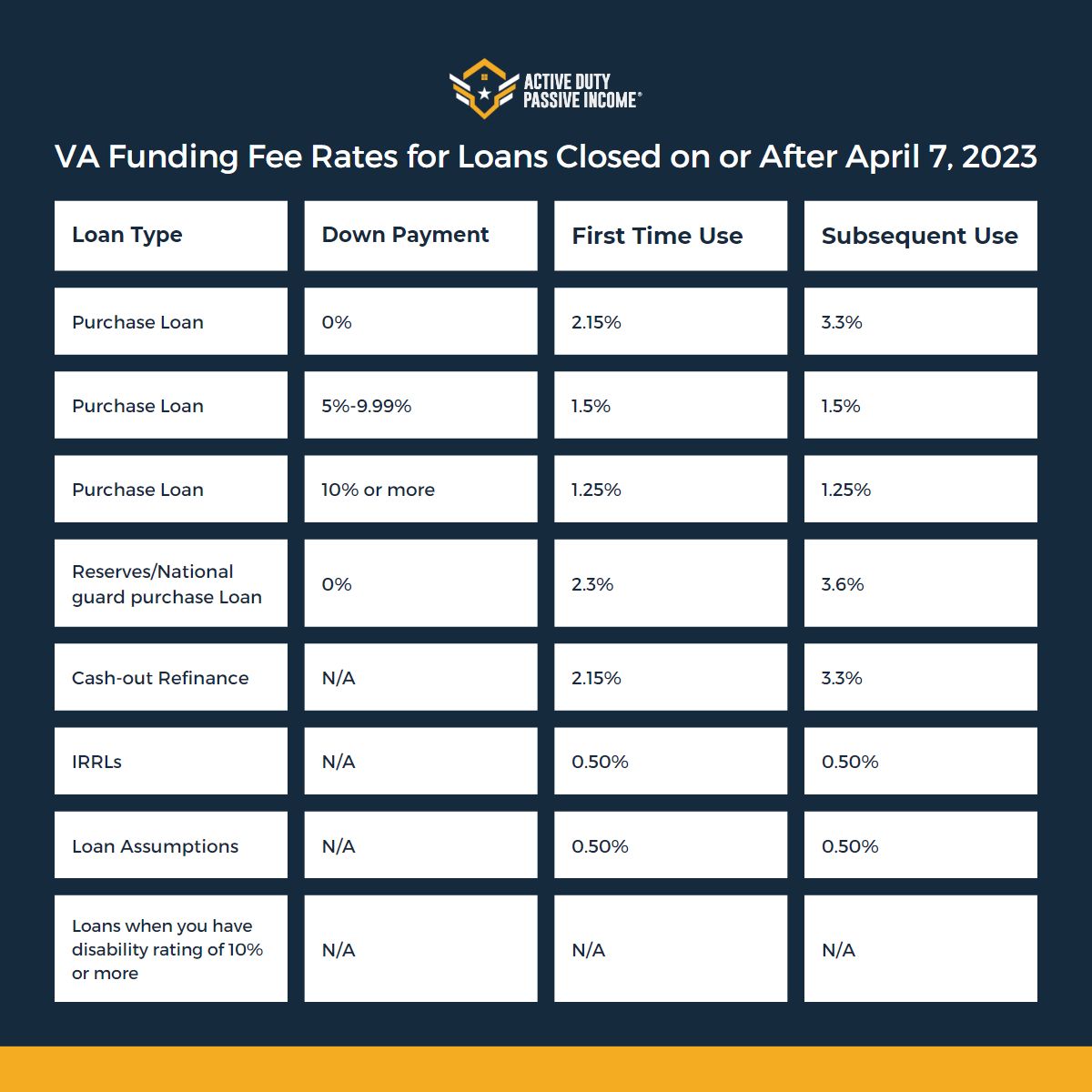

Va Mortgages try secured because of the Pros Administration having an excellent name away from 15 to 3 decades. These types of financing are a good choice for being qualified veterans discover 100% financing. Virtual assistant loans require a funding fee and that’s paid in bucks or financed about amount borrowed.

Low down Payment Zero Down payment

In inside efforts to manufacture down-payment autonomy for our rural clients, USDA’s Outlying Innovation system makes it possible for Lowest and no advance payment programs, fundamentally zero month-to-month PMI with low interest.

The newest USDA Rural Invention system offers 30 season fixed rates and are popular getting customers searching for house during the rural elements.

Va Financing Being qualified Experts

Such finance consist of zero earnings without house confirmation loans. There are many different activities that can determine how this new low-conforming financing is made for the debtor. A few of the variables are:

- The latest debtor might not be able to document the, part of otherwise people earnings anyway.

- Asset verification might not be required and it has so you’re able to getting assessed toward an instance by the instance base.

- Loans are structured hence needs shorter documentation.

- Credit problem borrowers are qualified to receive specific low-compliant mortgage software. (These may tend to be later repayments towards the debt, open judgments, collection account, and you can overdue membership.)

- This new debtor might require dollars-out of the refinancing.

- No P.Yards.I. expected of all non-compliant mortgage things.

- Also Anybody else

Help to select the pleased set

We all know it is far from simply a mortgage for you. It’s your home, in which you every gather all over dinning table, snuggle upon the sofa to each other, even waiting line with the bath regarding days. It’s in which lifetime takes place.

For this reason i will be there to simply help at each phase of the mortgage processes so we possess certified mortgage advisors inside the the part to produce information and you may information.

Publication a home loan Appointment

The latest People merely gives into assets in Northern Ireland. To help you by way of each step of your house-possessing excursion, strategy a meeting with our devoted Financial Advisers during the a time smoother for your requirements.

Fool around with our financial calculator lower than

Play with all of our home loan calculator to gain access to our most recent mortgage profit. You get a sense of simply how much you might acquire and you will contrast monthly obligations. The fresh month-to-month costs mentioned are derived from an installment kind of (resource plus focus) mortgage across the title chosen. It calculator is for illustrative intentions merely that is maybe not a great mortgage render. Prior to agreeing financing, a cards look and full software is expected, and you can the lending requirements have to be fulfilled.

دیدگاهتان را بنویسید