For this free online event, we typically host 90+ sessions, client panels, expert guest speakers, market updates and more. We also try to keep it fun, with points and prizes awarded for attending sessions and engaging via chat. All videos are on demand, so you can tailor the experience to fit your own business. After the event, most sessions are added to the Help Center. Written with Yardi Breeze client Chantel Figueroa, these are the best features of property management software. fixed costs: definition formula & examples They make up the bulk of marketing, leasing, financial and operational tasks you face.

Learn how to manage the tenant lifecycle, use RentCafe and much more. Times change and with proper preparation, you can be ready for the days ahead. Yardi has created tools and free online training courses to help its clients work productively, efficiently and securely.

Watch Training Videos on Client Central

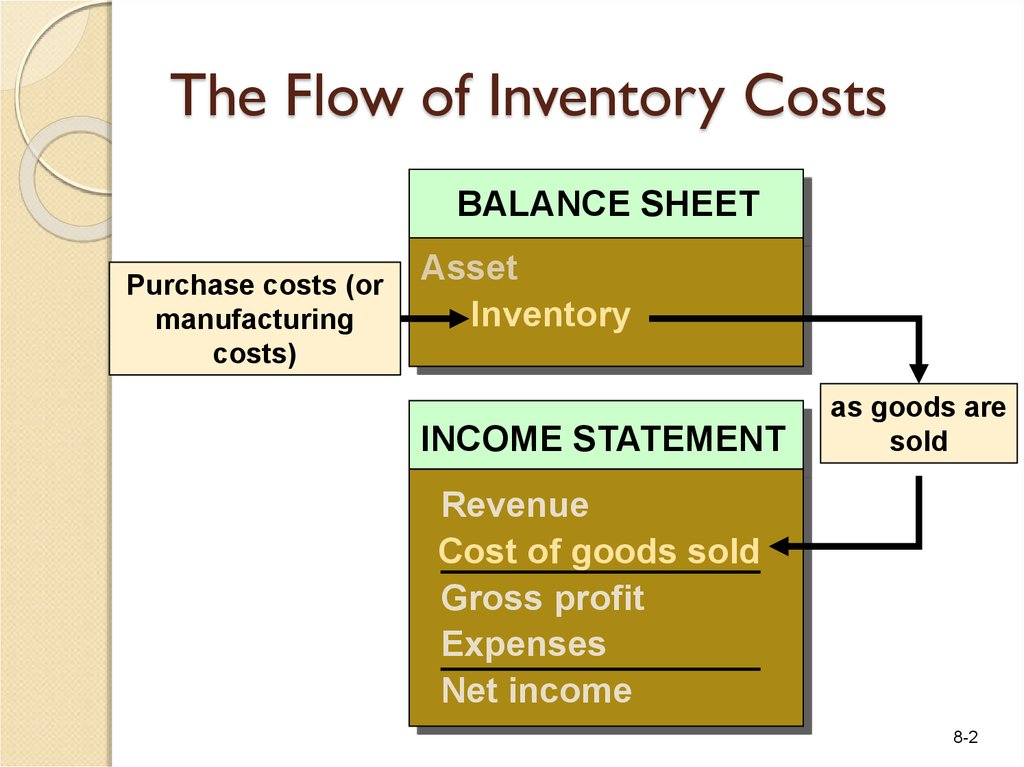

Yardi Breeze is property management software designed for you. Rest easy knowing your reports are accurate with Yardi’s trusted, built-in accounting system to track your revenue and expenses. And since Breeze is in the cloud, you can work lbos for smaller companies from anywhere and get fantastic support when you need it. Video learning is great – and is proven to boost retention – but sometimes you just want training from a real live person.

Not yet a Breeze client? Start here!

Once you’re logged in, you can watch as many videos as you like. Yardi offers robust, configurable software to meet the needs of nearly 20 verticals. From students to seniors and parks to ports, property management runs on Yardi! But what do you do when you want to get more out of your user experience? Who has the time to read lengthy product descriptions and how-to articles? That’s why our awesome team also creates wonderful Yardi Breeze videos.

- You can also find ebooks, videos, client success stories and other tools on the Resources page to learn how to drive success with technology.

- All property managers looking to get more out of their tech should watch this video.

- We’ve recently added some new videos to help you learn more about our refreshingly simple property management software.

- The Moments of Genius series, for example, offers excellent tips on our RentCafe marketing and leasing software.

Webinars

There are dozens of webinar sessions scheduled on Client Central, and new webinars are added frequently. Yardi users can sign up to learn everything from account trees to SQL scripting, and much more. Register for a webinar to get a closer look at our refreshingly simple software. All webinars are on demand, so just visit the webinar section of our events page to make your selection. Just visit our Features page, click “Play Video” and follow the what is the journal entry to record a gain contingency in the financial statements prompts.

Learn about the different kinds of webinars available to you and see which ones fit your schedule. You don’t have to be a Breeze user to attend some of them, but users get access to more robust webinar content. Yardi Aspire is the go-to learning tool for employees who want to become Yardi product experts. Users gain access to hundreds of in-depth courses taught by product specialists. Through learning checks and tests, you can assess your product knowledge.

Yardi Breeze Premier helps property managers organize their relationships in one place. Focus on growing your business while shrinking your list of headaches. Schedule a personal demo with one of our friendly team members who will walk you through the software and answer all your questions. According to its mission statement, Yardi focuses on quality and ease of use, as well as its relationships with both employees and clients.

As a bonus, you can take full advantage of our extensive video training library on Client Central. If you already use Yardi Breeze, you’re probably familiar with the features above and don’t need to watch the product videos. Instead, we’ve got free Yardi Breeze help videos designed to let you learn at your own pace, at any time that’s convenient for you. Independent consultants are verified experts on Yardi software.